The groups are asking Congress to pass legislation to protect constituents from flood risk.

TALLAHASSEE, Florida – The Florida Floodplain Manager’s Association is joining over 130 groups across the country, including eight in Florida, that would protect families, renters, and homebuyers from a property’s undisclosed flood history. The groups want congressional leaders to act on legislation that would create a federal flood risk disclosure requirement for home sellers in flood-prone areas.

Read: Letter to Congress supporting the creation of a federal flood risk disclosure requirement.

Though prone to flooding, Florida is among the states that do not require a flood disclosure during the process of selling a home. Right now, lenders, and not sellers, are federally required to notify borrowers only if they are required to have flood insurance. The proposed legislation would require sellers to provide homeowners, businesses, and renters with useful, timely information regarding flood risk, any history of flooding, or flooding damages known to the seller.

Click on the video above to watch the report “Florida is the ‘most flood-prone’ state with no flood disclosure laws,” from WTLV in Jacksonville on September 15, 2020

“Protecting families and keeping them informed on the risks associated with both past and future flood events is a national issue that requires a federal solution,” says My Flood Risk Director of Operations Amanda Bryant. “It is time to end the costly and dangerous cycle of leaving families uninformed on the true issues associated with repeatedly flooded properties. Congress should take up and pass legislation requiring flood risk and history disclosure today.”

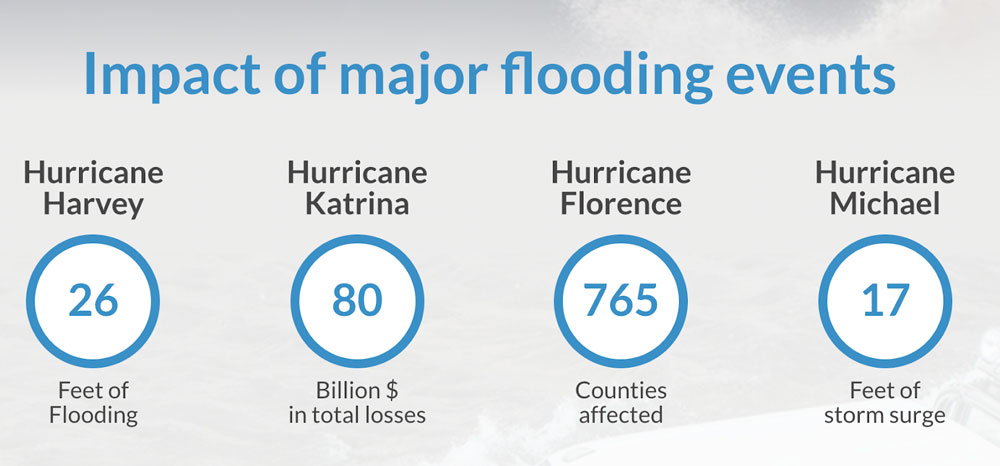

Data and graphic via MyFloodRisk.org

The move toward better disclosure and more standard information aims to lessen confusion and prevent financial damage for homebuyers caught unaware of their actual flood risk based on the property’s history, instead of just disclosing that it is in a flood zone.

According to My Flood Risk, for families living in a 100-year floodplain, the likelihood of a flood occurring during the lifetime of a 30-year mortgage is roughly one in four. They report that the problem is potentially worse for homebuyers and renters who may live outside mapped risk zones and may never be aware of their risk or past flooding.

More resources:

Data from Pew Charitable Trusts

- 74 percent of Americans support national flood disclosure standards

- Lack of Flood Risk Disclosure Law Leaves Homebuyers at Risk

- Florida: Flood risk and mitigation

Story by WFTS ABC Action News Tampa

- Pinellas County leading the way in warning potential home buyers of flood risks

- Video: https://bit.ly/2LJgHP5

Opinion Editorial in the South Florida Sun-Sentinel

- As flood threat grows, Florida must put homebuyers first and require flood risk disclosure

by Guy McClurkan, Federal Association for Insurance Reform (FAIR)

Opinion Editorial in Tampa Bay Times:

- When it comes to flood risk, more data equals better decisions

by Amanda Bryant, My Flood Risk

Article in the Tallahassee Democrat:

- Flood disclosure should be mandatory, insurance lobbyists say

by Jeff Schweers

Main photo above: A truck drives through water on a flooded street in downtown Jacksonville, Florida, in 2017 during Hurricane Irma’s Aftermath. Photo by Wade Austin Ellis on Unsplash.