What if real estate agents told prospective buyers that the property they are about to look at has flooded in the past? What if real estate agents told folks not living in a Special Flood Hazard Area that it would still be a really good idea to purchase flood insurance? Wouldn’t it be great if real estate agents received training to help them explain flood risk and flood insurance rates so that their clients could make educated decisions about purchasing homes? Well, in Pinellas County, Florida, that’s now a reality.

Lisa Foster, floodplain administrator for Pinellas County since 2016, said development of the Real Estate Flood Disclosure training program was a team effort. Back in 2014, the county kicked off a Program for Public Information, an important outreach tool in the Community Rating System. Rahim Harji, the then Pinellas County floodplain administrator, Foster, a consultant at the time, and Cece McKiernan, a consultant and executive director of the Florida Floodplain Managers Association, helped the county establish and develop the PPI. Several stakeholders attended the first PPI committee, including two Realtors from the Pinellas Realtor Organization. When discussions about FEMA, FIRM, BFE, flood hazards, building regulations, flood insurance and Coastal Barrier Resources Act came up, the PRO folks said many real estate agents lack understanding about flood zones and insurance requirements and that the information is not readily available to them.

Lisa Foster, floodplain administrator for Pinellas County since 2016, said development of the Real Estate Flood Disclosure training program was a team effort. Back in 2014, the county kicked off a Program for Public Information, an important outreach tool in the Community Rating System. Rahim Harji, the then Pinellas County floodplain administrator, Foster, a consultant at the time, and Cece McKiernan, a consultant and executive director of the Florida Floodplain Managers Association, helped the county establish and develop the PPI. Several stakeholders attended the first PPI committee, including two Realtors from the Pinellas Realtor Organization. When discussions about FEMA, FIRM, BFE, flood hazards, building regulations, flood insurance and Coastal Barrier Resources Act came up, the PRO folks said many real estate agents lack understanding about flood zones and insurance requirements and that the information is not readily available to them.

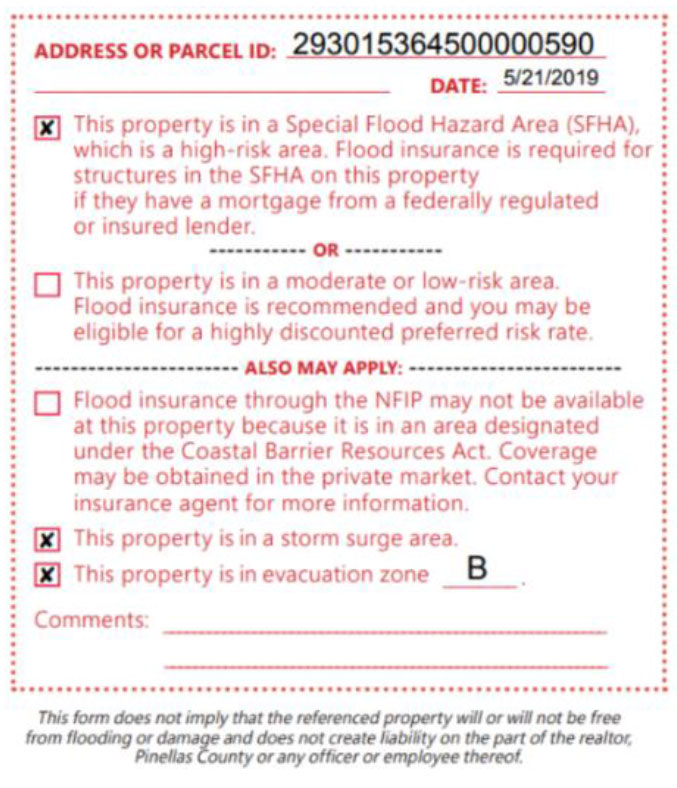

Those statements clicked for Foster and the newly established PPI Committee, because if real estate agents don’t understand about FEMA, FIRM, BFE, flood hazards, building regulations, flood insurance and Coastal Barrier, how are buyers going to understand? And that’s how the concept of the flood disclosure brochure and real estate training program came about.

“I always tell the Realtors in our class that I am only one person, and I need their help to educate our residents and businesses about flood risk and flood insurance rates and requirements so they can make educated decisions about their investments,” Foster said. “I also emphasize that we are not asking them to make decisions for their clients, just to provide them the information they need to make the decision that is right for them.”

“I always tell the Realtors in our class that I am only one person, and I need their help to educate our residents and businesses about flood risk and flood insurance rates and requirements so they can make educated decisions about their investments,” Foster said. “I also emphasize that we are not asking them to make decisions for their clients, just to provide them the information they need to make the decision that is right for them.”

Florida does require that if a seller knows their house has flooded, they must disclose it. But the state doesn’t require sellers to disclose flood zones, insurance requirements, evacuation zones or storm surge areas. So this is all voluntary. Foster said real estate agents often leave the flood disclosure brochures at their open houses. “This information empowers agents, gives them information and gives them an edge over other real estate professionals who aren’t in the training and aren’t participating in this. They want to do what’s right. They want to protect their clients,” she said.

Class sizes range from 40-140, and so far they’ve held eight one-day classes at the PRO office. “Plus we’ve had a few ‘mini’ classes, so I would guestimate over 500 Realtors have come through,” Foster said.

She said the county has also done many shorter presentations at real estate offices, insurance companies, title companies and other groups. “We get requests through our speakers bureau. When they are in one of the municipalities, I invite the floodplain staff from those jurisdictions and sometimes they do the presentation in lieu of me. Via our PPI, we have several flood insurance advocates who do trainings at real estate offices around the county as well,” Foster said.

Realtors really are the boots-on-the-ground people when it comes to flood risk education. “Any way you look at it, real estate agents are a critical piece to floodplain management. I am just one person in the county. But there are hundreds of agents in the county,” she said. Foster said she would encourage other communities thinking about starting a similar program to “Go for it! Go ahead and use what we’ve already developed. And your starting point should definitely be with your local real estate organization.”